What is LCA/GC?

LCA stands for Labor Condition Application which the Employer needs to file with US Department of Labor (DOL) before they file the H1B petition with (USCIS) United States Citizenship and Immigration Services.

A Labor Certification is a document issued by the Department of Labor that allows an Employer to file an employment based immigration petition on behalf of the employee as it is the first step in the (GC) Green Card process.

The filing can be done for any nonimmigrant worker through the (iCERT) portal system which is basically DOL’s online system. The offered wage in the LCA must be equal to or higher than the wage the employer pays others for the same position.

LCA filing basically contains information regarding the kind of job position offered for the foreign worker. The filing of the LCA is important as it protects foreign workers fundamental rights at work location in terms of wages, working conditions, benefits and policies.

Furnishing any false information in the LCA documentation is a federal offense and punishable by a fine. If the Employer fails to pay an H-1B worker the required wage he is liable to make back pay or sum up the deficiency. As part of public disclosure Dept. of Labor publishes the LCA data which can be accessed at the DOL website.

How Nimble Accounting can be of help?

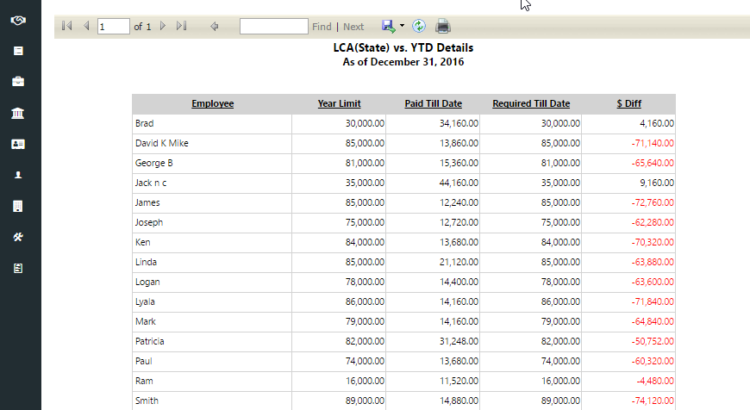

Nimble Accounting’s expertise can be of great help for Business owners when complying with LCA/GC regulations. In Nimble Accounting, Users can enter LCA details for their respective Consultants according to GC or State wise in the Employment info section. Business Owners can view monthly or yearly customized reports between LCA/GC and LCA & YTD.

Before Payroll Process, GC/LCA reports helps in avoiding I-140 rejections, timely information on GC/LCA makes consultants very happy and avoids unnecessary audits resulting in penalties

If a Consultant is falling short of LCA norms, the difference amount can always be included in the Consultant’s Payroll in accordance to the amount which helps in avoiding unfair penalties. Real-time customizable Report provides workflow status for LCA filings giving instant visibility at a glance. This way Nimble Accounting helps Business Owners to place Consultant in accordance to LCA regulations saving time and unfair fines on a long run.